Money talk can be overwhelming. If you’re worried about your own finances or just want to meet some specific financial goals, creating a personal budget should be everyone’s first step!

What is a budget?

A budget is an estimate of your income and expenses during a set period of time. Often a personal budget will track these estimates on a monthly basis. It’s a tool that allows you to see your personal financial snapshot visually, whether it’s through a spreadsheet on your computer or a specialized budgeting app.

The basic components of any budget are:

- Income – what you earn (after taxes)

- Fixed expenses – any monthly bill that stays the same each month, like rent or cable

- Variable expenses – any monthly bill or expense that changes each month, like utilities

- Savings – how much money you can put toward savings or miscellaneous spending each month

Why should everybody create a budget?

When you use a budget to track your money, you ensure that you aren’t spending more money than you’re making each month. This allows you to live below your means. When you budget for the month, you are taking a gigantic leap towards financial freedom. You can make sure that all of your bills are paid on time and you can start working towards larger financial goals.

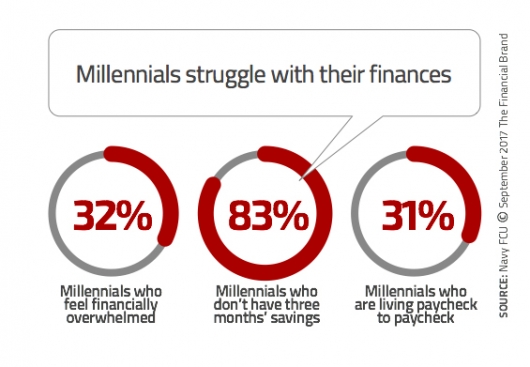

Too many Americans live paycheck to paycheck. Too many people struggle to reach the financial goals they set for themselves. Creating a monthly budget for your personal finances is the first step towards changing that.

How to start your personalized budget.

-

Research your own financial history

You need to fully understand your own financial status. Make a list of all of your current assets and debt. This includes savings accounts, checking accounts, retirement funds, student loans, car loans, credit card debt, and more! You can even calculate your net worth.

Some helpful resources to find this data are your own bank statements for the past few months and a FREE credit report.

-

Track your spending for one month – minimum.

Once you have a list of all of the accounts and loans under your name, it’s time to track what you’re truly spending per month. For at least one month, record every single purchase you make, every bill you pay, and every automatic bank transfer. This will allow you to create a personalized budget based on real, factual numbers.

You can track this with just a pen or paper. Or look for an app like Mint to download on your phone. Either way, it’s time to shine a light on where all of your money goes each month.

-

Fill out your monthly budget estimate.

Once you have all the data, it’s time to plug it in. Create a budget spreadsheet that incorporates all of the basic components listed at the beginning of the article. You can get as detailed as you want. Your budget will be unique to your situation.

How does the budget add up? Are your monthly expenses totaling more than your monthly income? Were you surprised at how much you were spending on a specific good or service? How much of your expenses are needs, and how many are wants?

If your expenses added up to more than your monthly income, the first step is to see where you can cut the expenses. You want to live below your means. This could be as small as cancelling your cable TV service, or as large as moving in with roommates.

If you have extra money left over in your budget, decide the best course of action for those funds. We recommend devoting that money towards things like saving up an emergency fund or adding to your retirement contributions. Plus, now that you can see all of your expenses laid out clearly, you can cut back in certain areas to achieve the goals that are important to you.

Here are some ideas for financial goals:

- Pay off high-interest debt (like credit cards)

- Save up 3-6 months of living expenses in an emergency fund

- Save up enough money for a down payment on a house or car

- Max out your yearly retirement contributions

Remember this is only a monthly budget. You’ll need to revisit it each month to revise the income and expenses and make adjustments as necessary.

Achieve your financial goals.

A personal monthly budget is an invaluable financial tool. Every financial expert, including White Rose Credit Union, highly recommends creating a budget! Let us know in the comments how finally starting your budget helped you better manage your money!

Subscribe to the Blog

Get more money advice by subscribing to the blog! We’ll send regular tips and resources straight to your email – no spam. Sign up now!

Oops! We could not locate your form.