Benefits

We are committed to our members, and our community. Our focus on Integrity, Commitment, Accountability, Respect, and Education is evident in all that we do. Our servant based leadership and training help prepare you to not only best serve our members but grow within the credit union.

Our team enjoys perks such as:

- First shift hours

- Paid holidays off

- Generous Paid Time Off

- Paid Volunteer Time Off

- Employee Benefits

- Employee Assistance Program

- Training and educational

- Advancement opportunities

The Credit Union Difference

Different from a bank, credit unions are not-for-profit financial institutions where our members are part owners. This means lower fees, competitive loan rates, and access to a ton of free services since we invest back in our members, rather than corporate shareholders.

We pride ourselves on the work we do with our community, and our commitment to educating our members to help them achieve their financial goals.

Leadership

Board of Directors

James R. Sanford, John A. Brownlee Jr., Keith A. Cosgrove,

Christopher M. Derouaux, George V. Watson

You can apply to any of our listed positions by filling out the online application, you can submit your resume to employment@whiterosecu.com, or you can pick up an application at any of our convenient locations.

The length of the hiring process depends on the position and operations of the credit union. Once applications are reviewed, initial candidates will participate in a brief phone interview. Following a successful phone interview, applicants will be invited to an in-person interview.

The credit union welcomes new team members with a friendly, in-person orientation process. New employees will begin their training at our Corporate Office and may spend up to three weeks with our dedicated Training Specialist depending on experience and the position. The program includes a mix of hands-on and online course training.

Team members will continue training in their respective department or branch following their time at our Corporate Office. We are proud of the inclusive, helpful, and safe work environment that is fostered for our new team members as they begin their #WhiteRoseCU Careers.

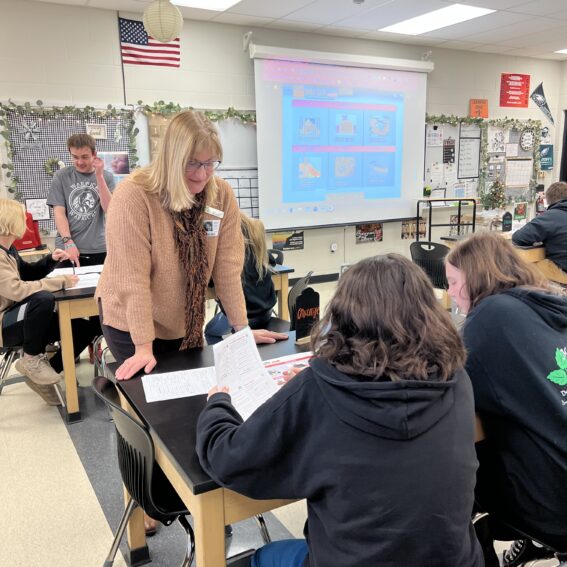

As part of our commitment to education and our community, we are happy to set-up job shadowing for both external and internal candidates.

We also offer customizable internships for local students. Please reach out to marketing@whiterosecu.com to learn more.