Writing a check may fall under the list of things they didn’t teach in school. But no worries, learning how to write a check is easy. Follow this guide if you’ve never written a check or just need a refresher.

Fill out these sections on a check

Writing checks isn’t as common these days, but checks are still a necessary form of payment for many people. These are the basic sections every check, no matter the financial institution, will have.

Date

Write the current date in this slot. You have the option to post-date it, or fill in a future date. However, this doesn’t guarantee that the payee can’t access the funds before that future date if they have the check in their possession.

Most types of dating are acceptable here, including:

- December 6, 2017

- 12/6/17

- 12/06/2017

Payee

This line starts with ‘Pay to the order of.’ On this line, you’ll write out the recipient of the check. The recipient could be a person or an organization.

Payment amount (numerical)

This section starts with a $ sign. In this small box, you’ll write out the numerical form of the payment. Make sure you include the cent portion of the amount.

Example-

- $100.00

- $32.75

- $0.85

Payment amount (in words)

Next, you’ll need to write out the payment amount in words, not just numbers. This eliminates any confusion about the payment amount and prevents a criminal from altering the amount. If the words don’t take up the entire line, draw a line to fill out the rest of the section. For added security, write out the amount in ALL CAPS. This also makes it harder to change the written amount.

Example–

- One hundred dollars and 00/100 cents

- Thirty-two dollars and 75/100 cents

- Zero dollars and 85/100 cents

Memo (optional)

If you’d like, you can use this line to write out what the payment is for. Some payees like to have this section filled out. For example, a landlord may ask you to write down your apartment number so they can keep track of which check belongs to which tenant.

Signature

The final step validates the check. The check cannot be cashed or deposited without a signature. Sign the check with the same name you use on the checking account. Make sure you fill out ALL sections in pen so that they can’t be fraudulently changed!

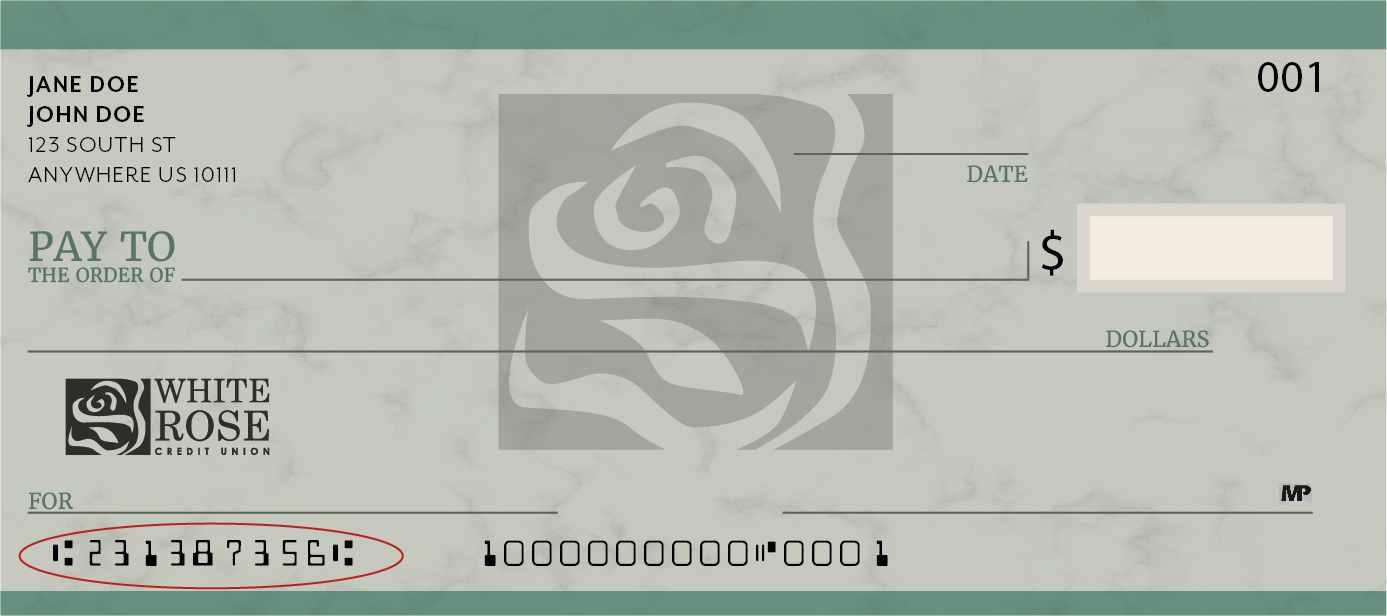

Banking information found on every check

A check is a good place to look for basic account information you may need. Here’s a few pieces of information you can find on your check.

Check number

This number simply identifies which check you’ve used in your checkbook. It’s a helpful reference number if you want to keep track what check you’ve used for each payee.

Routing number

This 9-digit number is found on the bottom left portion of your check. It’s the electronic address unique to your financial institution.

Checking account number

Your specific account number that is linked to the physical check is also located on the bottom of your check. The numbers will be separated by a printed symbol so you can see where the routing number ends and your account number begins.

FAQs about how to write a check

Q: What do I do if I make a mistake when filling out the check?

A: No problem! Just write in all caps, VOID, across the check and start fresh with a new check. We recommend you shred the voided check for safety.

Q: When do I need to sign the back of a check?

A: You only need to sign the back of a check if you’re the recipient of the check. You’ll sign it in the endorsement section in order to deposit or cash the amount.

Q: Can I write out a check to myself?

A: Absolutely! The reason some people do this is to transfer funds to a different account. You can withdrawal funds from one checking account, and take the check to a different financial institution to deposit into an account in your name there. You could also use a mobile deposit service through your bank’s app.

Q: Are there any payment alternatives to writing out a check?

A: Yes, there are! There are multiple types of electronic payments you can use if you’d rather skip writing a check. Here are just a few:

- Online bill payment tools through your online banking system

- Credit or debit card payments

- PayPal

How to balance your checkbook register

The checks that came with your checking account should also have come with a checkbook register. This register makes it easy to track every payment you’ve made with a check. Simply copy all of the information you filled out on the check into the corresponding lines in the register. This will include the date you wrote the check, who the payee was, and how much the payment was for.

In addition to tracking the checks you write, you can also use the checkbook to balance your entire checking account. This will include you filling in every deposit and withdrawal you made from your checking account, including debit card purchases. At the end of a month, you can compare your register with the bank or credit union’s statements.

The benefits of keeping a detailed checkbook register include:

- Tracking the exact amount in your account so you never bounce a check

- Being able to identify exactly where or to whom your money went, as opposed to a simple routing number on the back statement for payee identification

- These detailed records will also make it easy to spot a fraudulent purchase or withdrawal in your monthly statements

Have a question we didn’t answer? Leave it in the comments below!

Subscribe to the blog

Get more answers to your financial questions by subscribing to our blog. We’ll send out regular email updates when we have new articles posted. Sign up now!

Oops! We could not locate your form.